What is the trade life cycle, and how does it ensure smooth transaction processing?

The trade life cycle refers to the comprehensive journey a trade takes from initiation to settlement, ensuring a seamless transaction. It is a structured process designed to guarantee that trades are executed, verified, and settled accurately while adhering to market regulations.

By minimizing errors, mitigating risks, and ensuring compliance, the trade life cycle plays a vital role in the safety and efficiency of financial market transactions.

Top 5 Key Stages in the Trade Life Cycle

- Order Placement: The trade begins when an investor places an order to buy or sell a security. The order includes key details like asset type, price, quantity, and order validity. Investors can place orders through brokers or directly via trading platforms.

- Trade Execution: After the order is placed, it is executed by matching it with a corresponding buy or sell order. Execution happens on an exchange or trading platform where buyers and sellers meet and agree on transaction terms. This stage ensures readiness from both parties to proceed.

- Clearance: In the clearance phase, the trade is verified for accuracy. Clearinghouses ensure that both the buyer and seller possess the required funds or assets to fulfill the transaction. This step prevents discrepancies and safeguards the trade's integrity.

- Settlement Settlement marks the final stage where the buyer receives the purchased security, and the seller receives the payment. The exchange of money and assets occurs either physically or electronically, completing the trade.

- Post-Trade Processing: Once settled, post-trade activities take place. These include updating accounts, reporting to regulators, and ensuring compliance with legal standards. Both parties can also monitor their portfolios to confirm the transaction's accuracy.

How the Trade Life Cycle Ensures Smooth Transaction Processing

The trade life cycle ensures seamless transactions through:

- Risk Management: Verifies every stage of the trade to minimize risks like fraud, mismatches, or errors.

- Efficiency: Automates processes to speed up execution and reduce manual intervention.

- Transparency: Adheres to regulatory compliance and reporting requirements, fostering trust and integrity.

- Accuracy: Confirms obligations are met during clearance and settlement, reducing disputes.

- Security: Utilizes intermediaries like clearinghouses to ensure safe financial transactions.

Top 5 Benefits of Understanding the Trade Life Cycle

- Informed Decision-Making: Traders can make smarter decisions at every stage, from order placement to post-trade review.

- Reduced Risk: Awareness of the process helps identify and mitigate potential risks.

- Faster Execution: Knowing the life cycle accelerates transactions and optimizes performance.

- Regulatory Compliance: Ensures trades are legally compliant, avoiding complications.

- Improved Trade Strategies: Understanding timing and specifics allows traders to optimize entry and exit points effectively.

How the Trade Life Cycle Impacts Financial Markets

The trade life cycle is fundamental to the health and efficiency of financial markets, as it:

- Maintains Market Integrity:Trades are executed and settled according to regulations, ensuring fairness.

- Supports Liquidity: Proper execution and clearance keep liquidity flowing in the market.

- Boosts Investor Confidence: Smooth and transparent processes reassure investors about the reliability of their trades.

Understanding the trade life cycle is essential for traders and investors at all levels. It serves as the backbone for secure, reliable, and efficient transactions that drive the financial markets forward.

Recent Posts

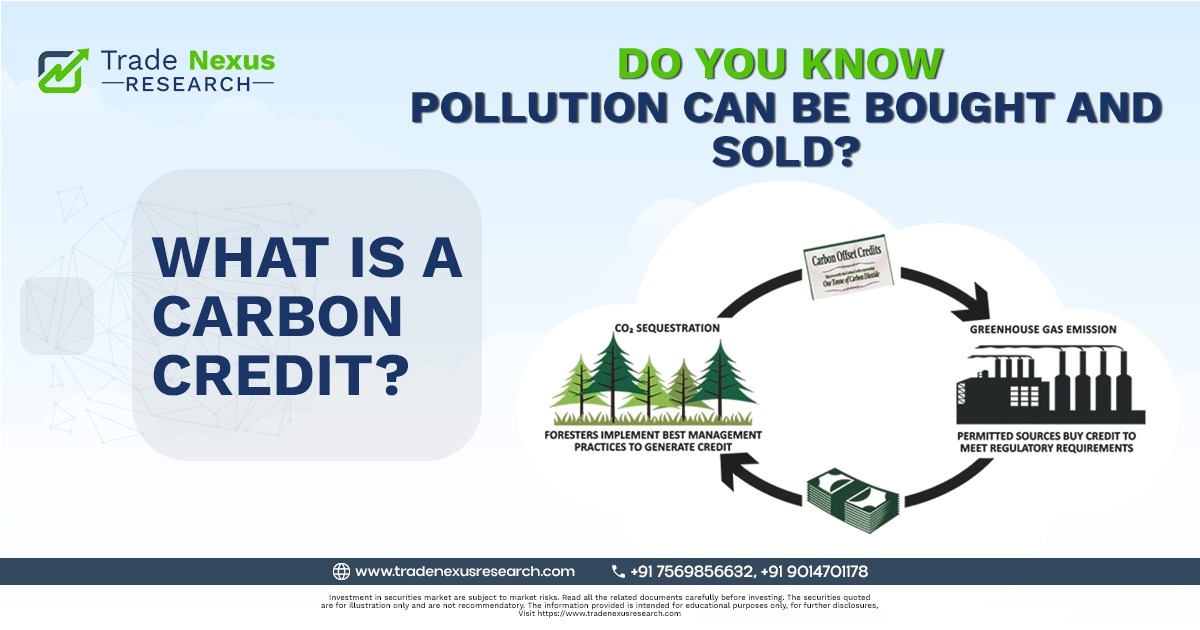

Carbon Credits in India 2025: Market, CCTS Policy & Business Opportunity

Do you know… pollution can be bought and sold? What if pollution could be bought and sold like a stock? It already can, surprisingly. It’s ...

Read More →

Stock Market Hyderabad: How Trade Nexus Research Helps You Win

Introduction: The Growing Influence of Stock Market Hyderabad Hyderabad isn’t just about pearls, biryani, and tech hubs—it’s also a rising powerhouse in the stock market ...

Read More →

What Is Book Value in Stock Market? The Smart Trader’s Guide

Introduction: What Is Book Value in Stock Market If you’ve ever wondered what is book value in stock market, it’s a vital concept for understanding ...

Read More →

Why Is Stock Market Up Today? Sensex Analysis & Trade Nexus Research Insights

Introduction: Why Is Stock Market Up Today? If you’ve been asking why is stock market up today, you’re not alone. Many investors woke up to ...

Read More →

What Is FPO in Stock Market? Your Complete Guide

Introduction: What Is FPO in Stock Market If you’ve ever wondered what is FPO in stock market, the answer is simple: FPO full form is ...

Read More →

Risk Management Is the Real Edge: Daily Trading Discipline for Long-Term Survival

Introduction: The Hidden Edge in Daily Trading – Why Risk Management is Your True Success Factor In the dynamic world of daily trading, where volatility ...

Read More →

What is DMA in the Stock Market? And How It Can Help You Trade Like a Pro

What is DMA in the Stock Market? DMA stands for Direct Market Access. With DMA in the stock market, you get direct access to the ...

Read More →