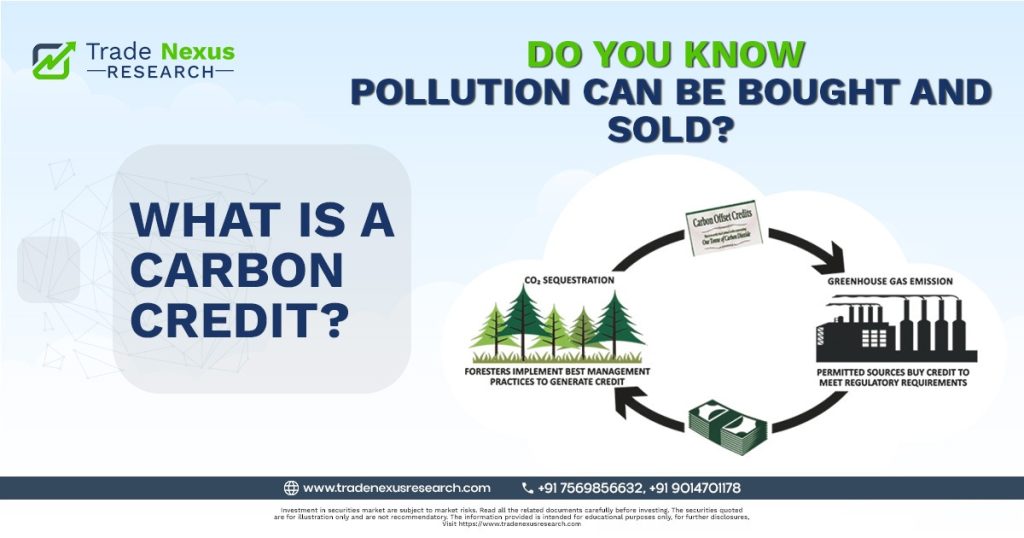

Do you know… pollution can be bought and sold?

What if pollution could be bought and sold like a stock? It already can, surprisingly.

It’s called Carbon Credits, and India is now building its carbon trading market under the Carbon Credit Trading Scheme, a policy that may redefine the future of Indian industry, energy, and investment.

What is a Carbon Credit?

A carbon credit is a tradable permit allowing the emission of one metric ton of carbon dioxide (CO₂) or a corresponding amount of other greenhouse gases. It is a market-based system where firms that exceed pollution limits purchase carbon credits from those that operate below their limits. This mechanism places economic pressure on heavy polluters while rewarding companies investing in cleaner technologies. Rather than fines, credits allow companies to offset their emissions and make sustainability profitable. Over time, it brings in innovation, reduces overall emissions, and supports the transition toward the low-carbon economy by turning environmental responsibility into a business advantage.

Carbon credit systems are built on the principle of making pollution costly while rewarding cleanliness. First, governments establish a limit on the emissions of certain industries and allocate allowances in accordance with that limit. If an organization emits more carbon than allowed, then it must purchase carbon credits from those organizations that can reduce emissions below their allowance and have extra allowances to sell. Conversely, businesses that emit less than their assigned limit can sell unused credits and generate additional income. This financial incentive promotes the use of cleaner technology, increases energy efficiency, and decreases dependence on fossil fuels. Over time, this system propels industries toward sustainability by converting environmental responsibility into a profitable business decision rather than a legal burden.

How can companies earn carbon credits?

A company can create carbon credits by:

✔ Installing solar or wind power

✔ Using energy-efficient technologies

✔ Transitioning to electric vehicles

✔ Adopting green manufacturing

✔ Planting of forests or reforestation projects

✔ Carbon emissions capture

✔ Waste-to-energy operations

Any carbon-reducing action that is verified creates credits.

India’s Carbon Credit Trading Scheme (CCTS)

India’s Carbon Credit Trading Scheme aims at creating an orderly national market in which carbon reduction becomes a tradable financial asset. Under the system, industries will be incentivized to monitor and reduce their emissions through certified measurement frameworks. Companies that actually reduce pollution, shift to renewable energy, or adopt clean production processes will be granted carbon credits that can be sold for a profit. Similarly, firms exceeding limits will be compelled to purchase credits, thereby increasing their cost of operations. This approach switches environmental protection from compliance to opportunity as a means for companies to earn while adopting sustainable practices. Over time, CCTS will have the effect of accelerating India’s transition toward a low-carbon economy, even as it enhances corporate accountability and environmental performance.

Carbon Credit Is NOT a Tax

Carbon credit is not any sort of tax issued by the government but rather a market-based system to give a price tag to pollution. Rather than punishment, it rewards clean companies through different trading mechanisms, including making polluters pay for their emissions, and encourages innovation, efficiency, and greener technology adoption in all industries.

Indian Companies Already Active in Carbon Credits

Several Indian companies are beneficiaries of the green economy wave:

ReNew Power

ReNew Power stands as one of the largest producers of renewable energy in India, essentially covering the spaces in solar and wind power generation. The company plays a major role in reducing India’s dependence on fossil fuels by delivering clean electricity at scale. Through renewable projects and sustainability initiatives, ReNew contributes directly to carbon reduction while strengthening profitability through long-term green energy contracts and carbon-saving operations.

Tata Power

Tata Power is aggressively expanding into clean energy with strong investments in solar, wind, hydro, electric vehicle charging, and green power distribution. It is gradually moving the business model away from coal-based power into sustainable infrastructure. Its focus on renewable capacity, rooftop solar, and EV networks positions Tata Power as a significant player in both India’s green transition and the future carbon-reduction economy.

EKI Energy Services Ltd

EKI Energy Services Ltd. specializes in the development and trading of carbon credits through measurement, reduction, and monetization services related to the carbon footprint of businesses. The company is involved in various projects on renewable energy, waste management, and environmental sustainability. By connecting Indian industries with global carbon markets, EKI transforms emission reduction into tradeable financial assets, making sustainability a direct source of revenue rather than just a compliance responsibility.

Why Carbon Credits Are a Business Opportunity

Carbon credits are not about charity or donations; they are a strong and emerging economic opportunity. The carbon credit market is bringing into life a completely new asset class wherein environmental responsibility transforms into financial value. Companies today can develop new streams of revenue from carbon credit trading, environmental finance, investments based on ESG, and green compliance consulting.

Governments around the world are enacting more difficult climate regulations while countries and companies are ready to pay for the purpose of carbon neutrality. Early-mover companies therefore secure a competitive advantage through reducing costs for compliance that will continue to rise in the future and opening up new revenue streams stemming from sustainable operations.

A strong commitment to low-carbon operations also enhances ESG scores, making businesses more attractive to global investors and financial institutions. Additionally, companies with green credentials enjoy better brand reputation, higher customer trust, and easier access to funding. Over time, carbon efficiency will be just as important as cost efficiency. Firms that move first will not just survive regulation but will profit from leadership in sustainability and future-proof their operations against rapid change in the global economy.

The Green Economy Is Here

Carbon credit is not a passing fad but a long-term transition in how businesses will function. Fossil fuels are a depleting asset, pollution now carries an economic price, and clean energy assures profit. India’s upcoming carbon market will redefine industries, and companies that move early will lead the economy of tomorrow. The green economy is already active – and those who ignore it risk being left behind.