What is Future Trading and why is it Popular Among Experience Traders?

Futures trading is a financial strategy that involves buying or selling standardized contracts for an asset at a predetermined price, to be settled at a specific future date. These contracts, called futures contracts, are traded on regulated exchanges and can involve a variety of underlying assets like commodities, currencies, or stock indices. Futures trading helps traders speculate on price movements or hedge against market volatility. Futures trading for beginners is an excellent way to understand market dynamics before diving into more complex strategies.

How Futures Trading Works

- Underlying Assets: Futures contracts can be tied to a range of assets, including oil, gold, agricultural products, stocks, or even cryptocurrency.

- Leverage: Traders only need to deposit a small percentage of the contract’s value as margin to control a larger position.

- Price Agreement: Buyers and sellers agree on a price for the future, protecting them from unexpected market swings.

- Settlement: Upon expiration, contracts are settled either by physical delivery of the asset or financial settlement. How to trade futures contracts depends on understanding these core mechanics.

Speculation in Futures Tradingt

Futures trading is popular among speculators because it allows them to profit from price movements without owning the actual asset. For example, a trader might buy an oil futures contract if they believe oil prices will rise. If prices increase, the trader can sell the contract at a higher price for a profit. Futures trading strategies like this can provide significant returns, especially when leveraged correctly.

Hedging Through Futures

Futures are widely used for hedging purposes. For instance, farmers and corporations often use futures to lock in prices for crops or materials to avoid market uncertainty. This allows businesses to stabilize costs and focus on operations. Profitable futures trading strategies often involve hedging against market risks, especially for businesses in volatile sectors.

Top 5 Benefits of Futures Trading

- Helps You Predict Prices: Futures trading lets you guess whether the price of something, like oil or gold, will go up or down. If you're right, you can make money from your prediction!

- Allows Small Investments: You don’t need a lot of money to start. You can control a bigger amount of something (like 100 barrels of oil) with just a small deposit, called "margin."

- Can Protect Businesses: If a farmer is worried about the price of crops going down, they can lock in a price for the future. This helps them make sure they get a fair price no matter what happens in the market.

- Easy to Buy and Sell: Futures markets are very active, so it’s easy to buy or sell your contracts whenever you want, which means you can make decisions quickly.

- Learn New Skills: Futures trading is a great way to learn about markets, how prices move, and how to make smart decisions with money.

Top 5 Risks of Futures Trading

While futures trading has many benefits, it also comes with certain risks. Knowing these risks can help you make better and more informed decisions:

- You Can Lose More Than You Invest: Futures trading uses leverage, which can magnify both profits and losses. If the market moves against your position, you could lose more money than your initial deposit.

- It’s Highly Volatile: Futures markets can change very quickly. For example, a sudden announcement in the news could make prices jump or fall in seconds.

- Complicated for Beginners: Futures trading involves many technical terms and rules. Without proper learning or guidance, it’s easy to make costly mistakes.

- Risk of Overtrading: Since futures markets operate almost around the clock, there’s a temptation to trade frequently. This can lead to losses if you’re not careful or if emotions take over.

- Margin Calls: If the market moves against your position, you may need to add more funds (known as a margin call). If you can’t, your position might get automatically closed, resulting in a loss.

Important Rules and Advice for Futures Trading

Here are the 5 most important rules or advice for futures trading that even a 7th-grade student can understand:

- Don’t Risk More Than You Can Afford to Lose: Just like when you play a game, it’s important not to bet more money than you can afford to lose. Futures can be risky, so make sure you're prepared!

- Do Your Homework: Before making any trades, learn about the market and how the prices of things like oil or wheat can change. Knowledge is key to making good decisions.

- Start Small: Just like learning to ride a bike, it’s best to start small. Begin with a little bit of money until you get the hang of it.

- Watch the Market: The market can change quickly, so it’s important to keep an eye on prices and news. If you understand the market, you can make better decisions.

- Be Patient and Think Long Term: Don’t expect to make a lot of money overnight. Successful futures trading takes time, so be patient and think ahead!

Why Trade Futures Instead of Stocks?

- Leverage: Futures require significantly less capital compared to stocks for the same market exposure.

- Hedging: Futures provide risk management strategies that are not commonly available in stock trading.

- Round-the-Clock Trading: Many futures markets operate 24/7, unlike stock markets with fixed trading hours.

- Ease of Short Selling: Futures contracts can be shorted effortlessly, without the need to borrow shares, as required in stock trading.

Which Is More Profitable: Futures or Options?

Both futures and options present unique advantages:

- Futures: Offer higher profit potential due to leverage but are inherently riskier.

- Options: Involve lower risk as losses are capped at the premium paid, though success often requires precise market timing.

Experienced traders select between the two based on market conditions, trading goals, and personal risk tolerance. Futures vs. Options is a choice defined by the individual trader’s objectives.

What Happens If Investors Hold a Futures Contract Until Expiration?

When a futures contract reaches its expiration date, there are two possible outcomes:

- Physical Delivery: The buyer receives the actual underlying asset (e.g., barrels of oil, bushels of wheat).

- Cash Settlement: The contract is settled financially, with profits or losses calculated based on the difference between the agreed contract price and the asset's current market price.

Trade on the Go: Anywhere, Anytime

Modern trading platforms empower traders to monitor the markets, execute trades, and analyze data directly from their smartphones or laptops. This flexibility enables trading from virtually any location, ensuring that opportunities are never missed.

Get Expert Guidance with Trade Nexus Research Services

Futures trading can be a rewarding yet complex journey, requiring a solid understanding of market trends and strategies. Access to expert guidance and reliable resources can significantly enhance your trading success.

Trade Nexus Research Services is dedicated to empowering traders with:

- Research-backed strategies

- In-depth market insights

- Tailored support for all skill levels

Whether you’re just starting out or refining advanced techniques, Trade Nexus offers tools and analytics designed to minimize risks and maximize opportunities. With a commitment to innovation and education, they are your trusted partner in navigating the dynamic world of futures trading confidently and successfully.

Recent Posts

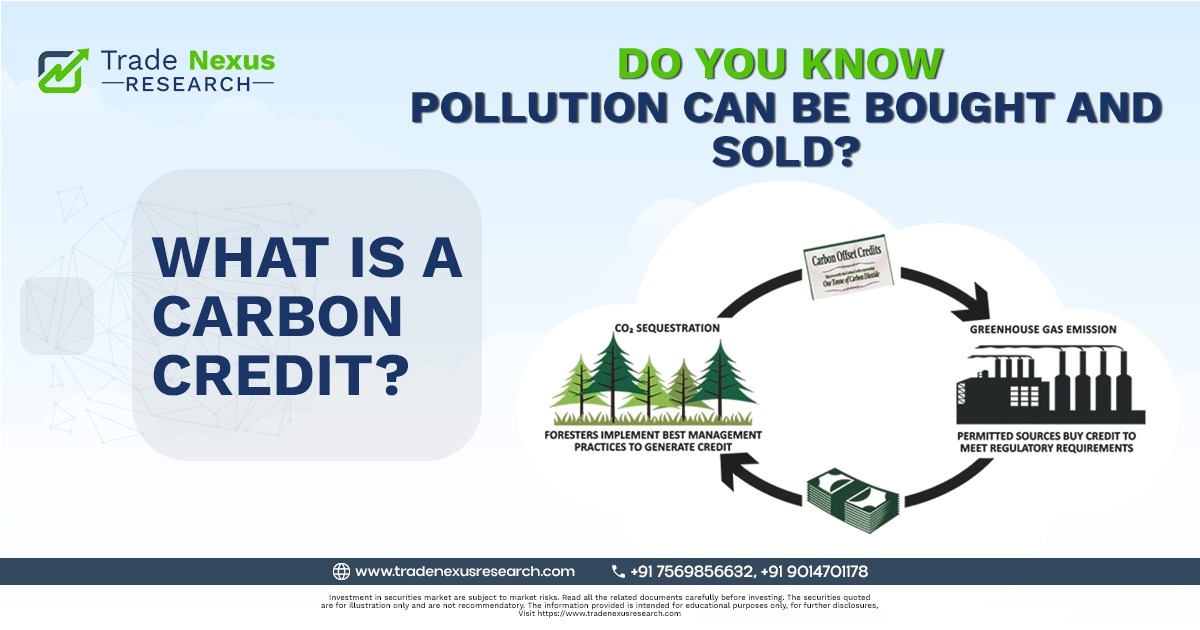

Carbon Credits in India 2025: Market, CCTS Policy & Business Opportunity

Do you know… pollution can be bought and sold? What if pollution could be bought and sold like a stock? It already can, surprisingly. It’s ...

Read More →

Stock Market Hyderabad: How Trade Nexus Research Helps You Win

Introduction: The Growing Influence of Stock Market Hyderabad Hyderabad isn’t just about pearls, biryani, and tech hubs—it’s also a rising powerhouse in the stock market ...

Read More →

What Is Book Value in Stock Market? The Smart Trader’s Guide

Introduction: What Is Book Value in Stock Market If you’ve ever wondered what is book value in stock market, it’s a vital concept for understanding ...

Read More →

Why Is Stock Market Up Today? Sensex Analysis & Trade Nexus Research Insights

Introduction: Why Is Stock Market Up Today? If you’ve been asking why is stock market up today, you’re not alone. Many investors woke up to ...

Read More →

What Is FPO in Stock Market? Your Complete Guide

Introduction: What Is FPO in Stock Market If you’ve ever wondered what is FPO in stock market, the answer is simple: FPO full form is ...

Read More →

Risk Management Is the Real Edge: Daily Trading Discipline for Long-Term Survival

Introduction: The Hidden Edge in Daily Trading – Why Risk Management is Your True Success Factor In the dynamic world of daily trading, where volatility ...

Read More →

What is DMA in the Stock Market? And How It Can Help You Trade Like a Pro

What is DMA in the Stock Market? DMA stands for Direct Market Access. With DMA in the stock market, you get direct access to the ...

Read More →